- Write the current month, day, and the year at the time you are making the deposit.

- The total of all the currency (paper money) you are depositing.

- The total of all the coin you are depositing.

- List of all the checks you are depositing, one per line.

- The total amount you are bringing to the bank.

- The amount of cash, if any, you want to take with you

- The amount of money you want to deposit in your checking account

- Signature when you receive your cash.

- Writing your check

Always make sure to write your checks in ink and to write clearly. If you make an error, prominently write VOID across the front of the check, and keep it with your cancelled checks.

Enter the date (month, day, and year) on the check you are writing.

Write the name of the person or business to whom you are making the payment to.

Enter the amount of the check in numbers, as close as possible to prevent anyone from attempting to increase the amount of the check. Also fill up the remaining space to the right with a line.

Enter the amount of the check in words as far left as possible. Write the cents as a fraction of 100 (for example, 26/100). Fill up all the remaining space with a line to prevent anyone from changing the amount.

Record the purpose of the check so you will remember why you wrote it.

Sign the check exactly as you signed the signature card when you opened your account.

Here is what is printed on your check:

- Your name and address

- The check number – each check has a different number

- The bank number so that the check you write will get back to us

- The bank name

- Your account number

Endorsing a check

When you receive a check made out to you, you must endorse it in the area indicated on the back side before you can convert it to cash or deposit it into your account. You should not write or mark anywhere on the back of a check other than within the indicated area. There are three main types of endorsements:

Blank Endorsement

When you wish to cash a check payable to you simply sign your name on the back of the check. Remember that once you endorse a check for cashing, anyone can cash it, so wait until you are in front of the teller before you endorse it. If your name is written on the check incorrectly, you should endorse the check twice; first, exactly as your name appears on the check, and second, as your name really appears on the bank’s record.

Restrictive Endorsement

“For Deposit Only” is a restrictive endorsement, when written on the back of the check followed by your signature. It is an instruction to the bank to only deposit that check to your account, not cash it. This protects you, because no one can cash a check endorsed this way.

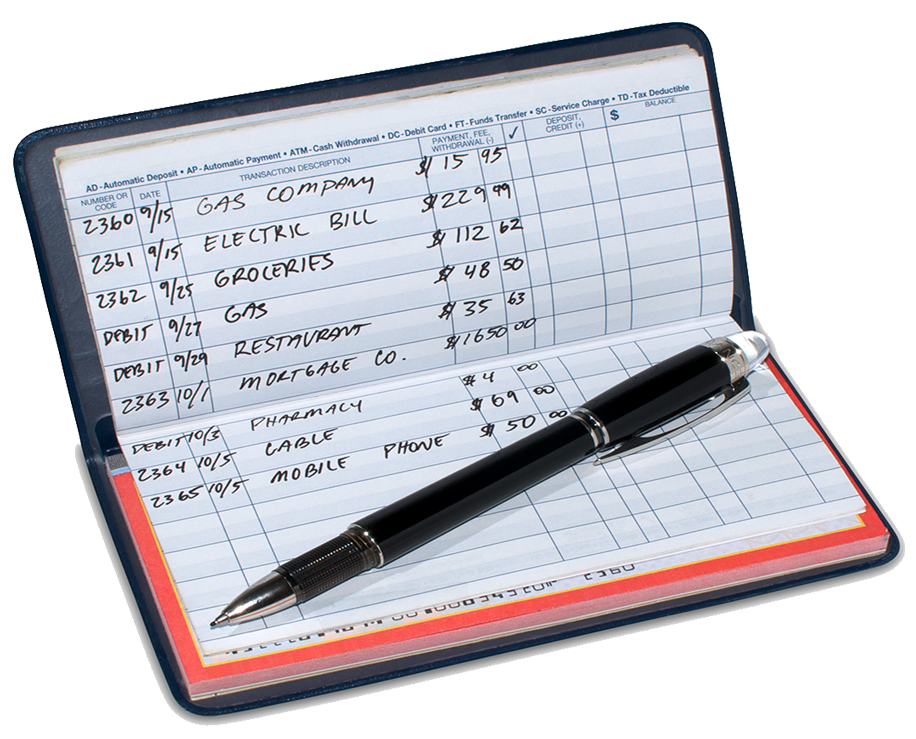

Recording your transactions

When you receive your checks, you will also receive a check register. This register is important because it is your record of how much money you have in your account, what checks you have written, and what deposits you have made.

- List the number of the check you are writing. The check number is found in the upper right hand corner of each check. This number will be printed on your monthly checking account statement when that check is returned to you.

- Write the name of the person or the company to whom you are making the payment to.

- Payment, or which particular month is covered by that check.

- Enter the date you are writing the check.

- List the amount of the check you are going to write or the amount of the deposit you are going to make. Make sure you record the exact amount that you write on the check or the deposit ticket.

- This is the amount remaining in your checking account after subtracting the check or adding the deposit.

- Use this column to mark off each check that has cleared when you balance your checkbook each month.